This textual content is an on-site mannequin of our Unhedged e-newsletter. Be part of here to get the e-newsletter despatched straight to your inbox every weekday

Good morning. Ethan is sleeping off his jet lag, so the indefatigable bond expert Kate Duguid has stepped in to help make clear the wild doings in prolonged Treasuries yields — arguably a really highly effective prices on the earth. If there are parts of the story we’ve missed, e mail us: robert.armstrong@ft.com and kate.duguid@ft.com.

Prolonged costs gone wild

It tells you one factor about economics and finance as scientific endeavours that very basic variables can change significantly and consultants inside the self-discipline disagree in regards to the causes. So it’s with the huge switch in long-term charges of curiosity in September.

The ten-year Treasury yield rose by about half a proportion degree closing month, to 4.6 per cent. There have been various months in 2022 all through which costs rose as fast or maybe a bit sooner, however it was less complicated to understand once more then, when the Fed was elevating costs at 75-basis degree slugs and inflation was rising. The Fed paused costs in September, and core inflation is flatlining. So what gives?

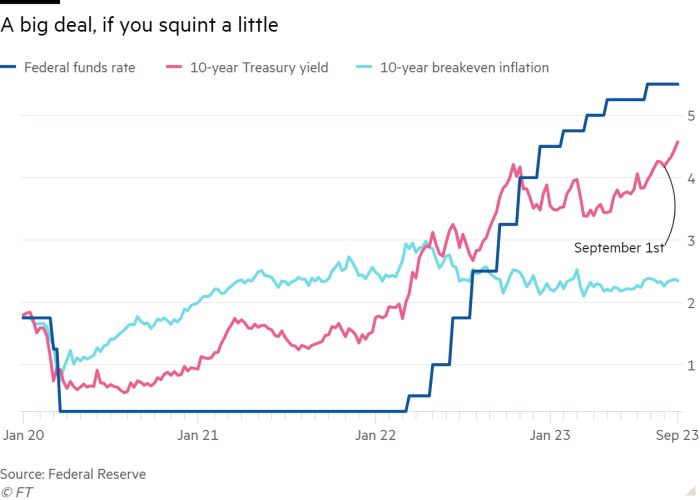

Considerably context on the outset helps. Proper right here’s a chart of the 10-year yield, the fed funds payment, and 10-year break-even inflation (the 10-year yield minus the 10-year inflation listed yield) since early 2020. Merely concentrates on the yield, in pink, for now:

A check out this chart serves to warning in direction of finding out an extreme quantity of into the present switch, as dramatic and stunning as a result of it has been. In a three-year view, the month’s switch appears to be like a blip. In a few years time, it will most probably disappear proper right into a broad narrative describing the current growth-inflation-policy-rates cycle. That narrative will most probably say one factor like: “there was a pandemic that shocked every present and demand, adopted by large monetary and financial stimulus, which led to large deficits and quite a lot of Treasury issuance; inflation rose, adopted by every transient and long term costs.” The exact order by which these points occurred is also waived away as noise.

That talked about, for these of us who’re attempting to find out what the market is telling us correct now, the switch couldn’t be further important. It isn’t even clear the place we’re inside the enterprise cycle, and we’re certainly not going to find out that out besides everyone knows why charges of curiosity are shifting as they’re. Prices are the true north in regardless of inadequate market compass we may have.

So, what explains the September spike? There are three most necessary theories:

Prolonged costs are signalling “bigger for longer” monetary protection. That’s most probably the consensus view, if there’s one. Closing Friday, the FT’s market report started out like this:

US shares registered their first unfavorable quarter of 2023 on Friday, ruling off on a bumpy three months for equities and bonds as merchants shifted to the possibility that although inflationary pressures is also easing, charges of curiosity will most probably keep bigger for longer.

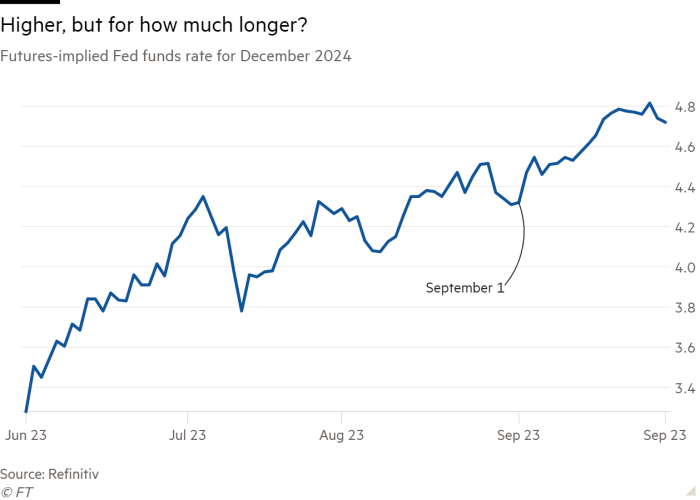

Simplicity makes this idea engaging. It moreover will get in any case partial assist from the markets estimates of what the Fed goes to do. Proper right here is the evolution of the futures market’s estimate of the protection payment on the end of 2024:

Given that start of September, the market has erased nearly two 25-basis degree payment cuts it had been anticipating. That should put some upward pressure on prolonged costs. Nevertheless yields moreover moved up sharply closing week, when end-2024 Fed fund expectations fell.

Completely different market indicators are a poor match with bigger for longer, too. The speed-sensitive two-year yield has moved about half as quite a bit because the ten 12 months in September, which is an odd match with the higher-for-longer story. Furthermore, as a result of the fees workforce on the Netherlands’ Rabobank degree out,

If the market did anticipate costs to be bigger for longer, would one not anticipate this to finish in a flatter curve — this as cuts are priced out and the longer run outlook for growth and inflation is adjusted downward? Prolonged-run inflation expectations are, in exact actuality, holding fairly common

You might even see inflation expectations going sideways inside the first chart, above. What’s driving prolonged costs up isn’t inflation expectations, nevertheless precise charges of curiosity. One can also anticipate bigger for longer to level out up in wider credit score rating spreads, too, as bigger costs apply pressure to floating payment enterprise debtors. Nevertheless spreads are principally unchanged simply recently.

Prolonged costs are signalling bigger growth expectations. That’s the common idea of Unhedged costs svengali Ed Al-Hussainy of Columbia Threadneedle. “Better growth expectations are feeding into the prolonged end. That’s corroborated by bigger oil prices and a greater dollar. This smells like a young landing. It might be that markets are catching as a lot as that idea,” talked about Al-Hussainy. It fits with the switch in precise costs comparatively than break-evens, too, and the sturdy data we now have had from enterprise funding. Nevertheless, as we now have written, the enlargement data has been good, nevertheless stays uneven and ambiguous, notably when one appears to be on the the rest of the world.

Prolonged costs mirror a greater time interval premium. The time interval premium — the additional yield on the prolonged end over and above the anticipated path of transient costs — has been low for a while. On the New York Fed’s estimate, it’s been reliably unfavorable since 2017. Presumably merchants are together with to the premium, pricing in some further risk to their estimates of the place raters are headed?

Michael Howell of CrossBorder Capital thinks time interval premia are rising, nevertheless not on account of bigger anticipated volatility; measures of anticipated volatility have been falling. He thinks, as a substitute, the supply-demand stability for prolonged Treasuries has modified for the extra extreme. There are further Treasuries and fewer urge for meals for them, as a result of the US funds outlook weakens and QT continues (The following lower Treasury values are harmful for risk asset liquidity and prices, because of Treasuries are a significant kind of shopping for and promoting collateral).

Jay Barry of JPMorgan agrees with Howell that monetary fundamentals and protection expectations can’t make clear all of the September spike, making a present/demand pushed spike inside the time interval premium an obvious clarification. He rejects the idea, though, arguing that the rise in present isn’t however acute enough to drive a fast enhance inside the time interval premium; he thinks it’s a narrative for 2024. His chart:

Barry locations the spike all the way in which all the way down to technical parts, as a substitute, much like modifications in investor positioning and jitters from the approaching authorities shutdown.

Barry is right in any case this far: the rise in present has been prolonged telegraphed. When the Treasury launched their borrowing plans for the quarter, they boosted present in 10- and 30- 12 months bonds. Nevertheless the additional present has been prolonged anticipated, and the auctions have gone simply.

What we anticipate. The higher for longer idea seems fallacious. The preponderance of data doesn’t seem to once more it. The enlargement idea is further promising, nevertheless might be heaps stronger if the monetary data was a lot much less equivocal. Given the mixed monetary data, this can be very seemingly the time interval premium is rising, nevertheless we don’t pretty see the proof for a shock Treasury present glut as of however. So whereas a combination of the second and third idea is our biggest guess, we’re nonetheless barely puzzled.

One good study

A glimpse of the west’s future?

FT Unhedged podcast

Can’t get enough of Unhedged? Take heed to our new podcast, hosted by Ethan Wu and Katie Martin, for a 15-minute dive into the newest markets data and financial headlines, twice per week. Compensate for earlier editions of the e-newsletter here.

Thank you for being a valued member of the Nirantara family! We appreciate your continued support and trust in our apps.

-

Nirantara Social - Stay connected with friends and loved ones. Download now:

Nirantara Social

-

Nirantara News - Get the latest news and updates on the go. Install the Nirantara News app:

Nirantara News

-

Nirantara Fashion - Discover the latest fashion trends and styles. Get the Nirantara Fashion app:

Nirantara Fashion

-

Nirantara TechBuzz - Stay up-to-date with the latest technology trends and news. Install the Nirantara TechBuzz app:

Nirantara Fashion

-

InfiniteTravelDeals24 - Find incredible travel deals and discounts. Install the InfiniteTravelDeals24 app:

InfiniteTravelDeals24

If you haven't already, we encourage you to download and experience these fantastic apps. Stay connected, informed, stylish, and explore amazing travel offers with the Nirantara family!

Source link