The spectre of a wider battle all by way of the Coronary coronary heart East poses a contemporary menace to the worldwide monetary system just because the world emerges from shocks triggered by Covid-19 and the Ukraine warfare, finance ministers and officers have warned.

Broader regional tensions would have essential monetary ramifications, they acknowledged, as they rounded off conferences of the IMF and World Monetary establishment in Morocco this week. The biannual events occurred as Israel declared battle on Hamas and launched an infinite bombardment of the Gaza Strip.

“If we face any escalation or extension of the battle to all the space we’re going to face big penalties,” Bruno Le Maire, France’s finance minister, instructed the Financial Events, together with that risks ranged from elevated energy prices stirring inflation, to a decline in confidence.

Kristalina Georgieva, the most effective of the IMF, warned of a “new cloud on not the sunniest horizon for the worldwide monetary system”, encapsulating fears among the many many many many delegates in Marrakech that the medium-term prospects for the worldwide monetary system are lukewarm.

On the other facet of the Atlantic, Jamie Dimon, chief authorities of JPMorgan, generally often known as this “most likely almost definitely primarily probably the most dangerous time the world has seen in a extremely very very long time”.

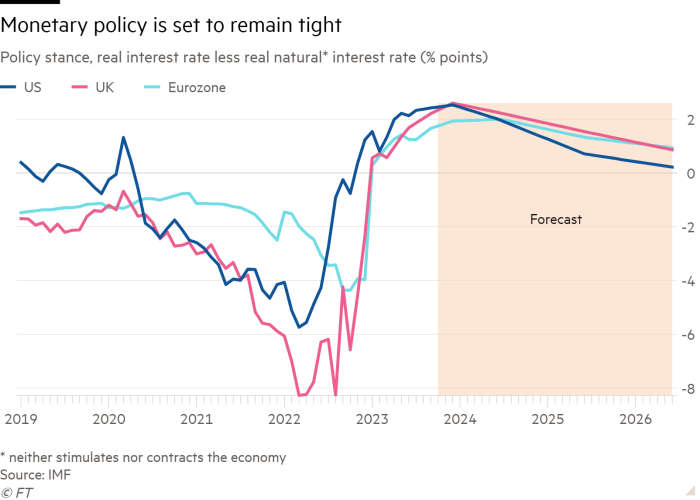

Heading into the conferences, officers had expressed low price that central banks had managed to curb inflation with out scary outright recessions — sidestepping a menace that the IMF flagged in April due to it spoke of a doable “arduous landing” for the worldwide monetary system.

Central banks appeared to have tightened monetary security, curbed credit score rating ranking rating enchancment, and cooled the labour market “with out overdoing it”, acknowledged Pierre-Olivier Gourinchas, the IMF chief economist earlier to the event.

Nonetheless, as delegates convened, the mood darkened on account of the broader implications of the Israel-Hamas warfare mixed with underlying nervousness about persistent vulnerabilities all by way of the worldwide monetary system. The IMF’s analysis pointed to worsening longer-term enchancment traits, as economies battle to boost productiveness, boundaries to free commerce mount amid worsening political tensions, and public debt rises world massive.

Notable all by way of the IMF’s short-term forecasts — prepared forward of the violence all by way of the Coronary coronary heart East broke out — was an absence of obvious good spots earlier a handful of countries such due to the US or India.

“There’s no accelerant appropriate correct proper right here,” acknowledged Joyce Chang, head of world evaluation at JPMorgan. “I don’t assume anyone seems like there’s an enormous catalyst over the next 12 months or so.”

The necessary challenge monetary hazard following the events of October 7, officers argued, was an escalation of combating in Israel and Gaza appropriate correct proper right into a wider regional battle. This gained’t solely hit confidence, nonetheless add a contemporary inflationary outburst to economies which is likely to be solely beginning to get bigger from a sequence of worth shocks.

The IMF believes a ten per cent rise in oil prices would elevate worldwide inflation by about 0.4 share parts.

Gita Gopinath, deputy head of the IMF, acknowledged the world was coping with “pretty quite a lot of shocks” along with the Coronary coronary heart East battle and its potential implications for energy prices.

Gopinath added: “Debt ranges are at report ranges and on the identical time we’re on this higher-for-longer curiosity [rate] ambiance. There’s pretty a bit . . . which will go mistaken.”

Paschal Donohoe, the most effective of the Eurogroup, instructed the Financial Events that the massive monetary question was over whether or not or not or not or not the battle would impact inflation expectations, and what which will level out for getting worth pressures down in 2024. Europe will proceed to develop due to the battle continues, he predicted, nonetheless at a lower tempo than he had hoped for.

Janet Yellen, the US Treasury secretary, acknowledged she was sticking collectively collectively alongside along with her delicate landing set up, telling reporters this week she doesn’t anticipate the battle to be a “primary potential driver of the worldwide monetary outlook”.

Nonetheless officers pressured the battle obtained correct proper right here at a time when the world monetary system was in a fragile state.

The worldwide monetary system is now extensively anticipated to develop at a relatively weak stage over the medium time interval, coming in at merely 3.1 per cent in 2028. That compares with a five-year outlook of three.6 per cent enchancment merely forward of the pandemic, and 4.9 per cent forward of the onset of the financial catastrophe.

Greater than 80 per cent of economies in the interim are coping with worse prospects from 15 years so far, based completely on the fund, for causes numerous from slower productiveness to a slowdown in inhabitants enchancment.

Added to that’s the fragmentation of the worldwide monetary system into competing blocs — a course of that’s sturdy to reverse and made all the additional potential by geopolitical tensions. The IMF estimated earlier this 12 months that mounting commerce boundaries alone may cut back worldwide monetary output by as pretty a bit as 7 per cent over the long term.

On prime of that come rising fiscal risks, on account of the worldwide public debt ratio climbs in route of 100 per cent of gross dwelling product by the tip of the last word decade. This has revived issues over debt sustainability at a time that Chang described as “inconvenient”.

Newest jitters on the planet’s largest financial market — US Treasuries — have been driving up worldwide borrowing costs merely as central banks have been shrinking their stability sheets, and authorities debt issuance was on the rise, she outlined.

Speaking at one among many closing panels of the annual conferences, Christine Lagarde, president of the European Central Monetary establishment, underscored merely how sturdy a set of circumstances these headwinds posed.

“There are all these balls all by way of the air,” she acknowledged. We aren’t exactly constructive the place they’re going to land.”

Further reporting by Martin Arnold in Frankfurt

Thank you for being a valued member of the Nirantara family! We appreciate your continued support and trust in our apps.

-

Nirantara Social - Stay connected with friends and loved ones. Download now:

Nirantara Social

-

Nirantara News - Get the latest news and updates on the go. Install the Nirantara News app:

Nirantara News

-

Nirantara Fashion - Discover the latest fashion trends and styles. Get the Nirantara Fashion app:

Nirantara Fashion

-

Nirantara TechBuzz - Stay up-to-date with the latest technology trends and news. Install the Nirantara TechBuzz app:

Nirantara Fashion

-

InfiniteTravelDeals24 - Find incredible travel deals and discounts. Install the InfiniteTravelDeals24 app:

InfiniteTravelDeals24

If you haven't already, we encourage you to download and experience these fantastic apps. Stay connected, informed, stylish, and explore amazing travel offers with the Nirantara family!

Source link