Deep in rural Minnesota, surrounded by fields of corn and soyabeans, Joe Biden tried to make clear the phrase he hopes will kick start his bid for re-election subsequent yr.

“Individuals, ‘Bidenomics’ is solely one different method of claiming the American dream,” he talked about remaining week at a farm in Northfield.

One yr out from an election that many analysts think about might probably be a defining second throughout the nation’s historic previous, Biden is persistently behind throughout the polls and beneath rising stress inside his celebration. Over the weekend David Axelrod, who was chief strategist for Barack Obama’s presidential campaigns, advisable it will not be “sensible” for Biden to even run in 2024, partly as a consequence of his age.

However Biden stays to be pressing ahead with a re-election bid and is betting each little factor on his personal monetary blueprint. In present months, he has embraced the time interval Bidenomics to promote his daring agenda, which is rooted in trillions of {{dollars}}’ value of public investments, a take care of middle-income staff and an aggressive methodology to rivals protection.

Biden insists his insurance coverage insurance policies symbolize a decisive break from 40 years of “trickle-down economics [which] restricted the dream to those on the prime”. A model new $25mn selling blitz in key battleground states tries to drive home the aim. “Right now, inflation is down. Unemployment the underside in a few years. There could also be further to do, nonetheless President Biden is getting outcomes that matter,” the narrator says.

Nonetheless worryingly for Biden and his Democratic celebration, voters keep overwhelmingly downbeat on the US financial system — and place the blame squarely on him. Even when the US is doing larger than most of its peer economies, irregular People don’t actually really feel that method about their residing necessities.

That leaves Biden weak to assaults from Republicans, who relentlessly accuse him of leaving People worse off. For them, Bidenomics is synonymous with acute sticker shock on meals and completely different frequently necessities as inflation stays historically extreme post-pandemic.

“Bidenomics has made each little factor costlier for Minnesota farmers, staff, and households,” the Republican Nationwide Committee talked about ahead of the president’s journey to the Midwestern state. “As the worth of farmland and diesel continues to surge, Biden’s insurance coverage insurance policies are crushing those who feed America.”

Opinion polling suggests the assaults are working — putting the president on shaky political flooring heading into an election yr.

“The financial system possibly points decrease than it used to in determining the results of nationwide elections, nonetheless for a lot of people, the kitchen desk factors, the bread and butter factors, these are nonetheless terribly essential,” says Maxwell Shulman, a non-partisan protection analyst at Beacon Protection Advisors.

A poll from the Associated Press and NORC on the School of Chicago remaining month confirmed that nearly three in 4 American adults describe the nationwide financial system as poor. About two-thirds talked about their household payments had risen over the earlier yr, and solely 1 / 4 talked about their incomes had elevated all through the similar interval.

Most worryingly for Biden, a New York Situations/Siena poll, revealed this week, found that merely 19 per cent of voters throughout the battleground states which will be extra more likely to determine the results of subsequent yr’s presidential election — Arizona, Georgia, Michigan, Nevada, Pennsylvania and Wisconsin — talked about monetary circumstances have been “good” or “fantastic”.

Merely 37 per cent of those in swing states talked about they trusted Biden over his potential Republican opponent, Donald Trump, to do a larger job on the financial system.

“The numbers are so harmful and may’t be outlined merely by [partisanship],” gives Shulman of present polling. “It seems to be as if a great deal of independents, a great deal of moderates, and even . . . Democrats don’t think about the financial system goes successfully.”

Democrats hope that good monetary data will in the end feed by to sentiment — and that the advertising and marketing marketing campaign will give Biden a chance to make clear what he has accomplished for voters.

Nonetheless so far, the pitch about Bidenomics doesn’t look like decreasing by. Many voters in battleground states all through the nation admit they do not know lots about his monetary insurance coverage insurance policies and question what the White House is doing to help them and their households.

“I don’t really understand the place he’s coming from with the complete Bidenomics issue,” says Rhonda Gurney, a gift retailer proprietor in Sunapee, New Hampshire, whose small enterprise is weighed down with larger transport and energy costs. “What are the insurance coverage insurance policies which will be being pointed to?”

‘Defying the naysayers’

Most governments in wealthy nations everywhere in the world are looking at America’s present monetary data with envy.

Inflation is down from remaining yr’s annual peak of 9.1 per cent, with the latest figures from the Bureau of Labor Statistics displaying the customer worth index rose 3.7 per cent in September in distinction with the similar time remaining yr.

Core inflation, which strips out dangerous meals and energy prices, was 4.1 per cent on a year-on-year basis, down from 6.6 per cent in September 2022.

For almost all of his administration, the roles market has moreover boomed. People in search of work haven’t solely been able to secure employment with relative ease however moreover jockey for larger pay throughout the course of. The tempo of month-to-month job optimistic elements has steadily declined over the earlier yr and in October slowed extra, in accordance with data launched remaining week. The unemployment cost has solely now started to creep up from multi-decade lows and at current hovers at 3.9 per cent.

Partly due to generous fiscal assist by means of the pandemic, consumers have spent in droves, fuelling strong monetary progress that has proved further resilient than anticipated beneath the burden of sharply larger borrowing costs imposed by the Federal Reserve.

No matter charges of curiosity in further of 5 per cent, the US financial system remaining quarter expanded at a blistering annualised tempo of 4.9 per cent. Whereas policymakers and economists depend on it to affordable from proper right here, progress has defied the worst prognoses so far.

“A yr previously, the consensus view was that unemployment would wish to go as a lot as 4.5 per cent and the financial system would wish to stall out with the intention to get inflation proper right down to the place it’s at current,” Lael Brainard, director of Biden’s Nationwide Monetary Council instructed reporters remaining month.

“Evidently was mistaken,” Brainard added. “US progress has been lots stronger than the naysayers believed, unemployment has remained below 4 per cent this entire time, nonetheless inflation has actually fallen in keeping with that forecast.”

These statistics have fuelled hope {{that a}} painful recession could also be prevented subsequent yr. “What we’ve seems to be like like a fragile landing with wonderful outcomes for the US financial system,” Treasury secretary Janet Yellen predicted in October.

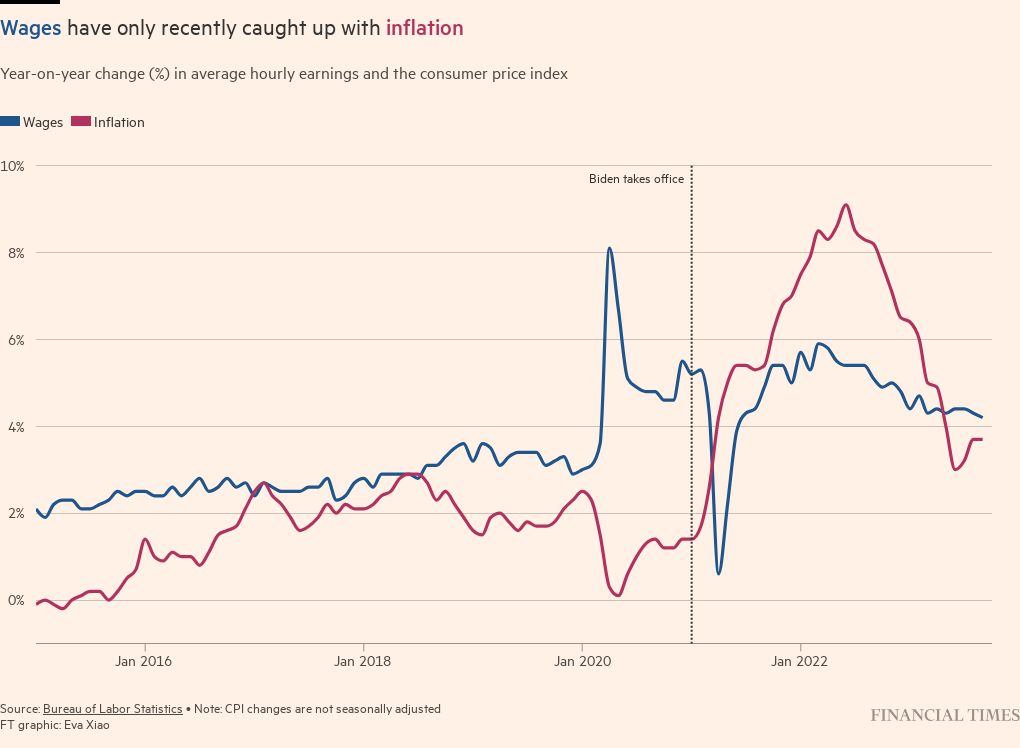

Nonetheless part of the problem for Biden is that concurrently People’ paychecks swelled, these optimistic elements since 2021 didn’t maintain with inflation until this summer season season — putting a large squeeze on household budgets.

On the similar time, the extent of customer prices nonetheless stays elevated for lots of things and suppliers, although the tempo of those will enhance has broadly slowed.

“Although the worth of milk now shouldn’t be altering, dorky economists like me will say, ‘Don’t you understand? That’s the excellence between a stage and a proportion change.’ And that’s the rationale people get so pissed off with economists,” says Seth Carpenter, a former Treasury and Fed official now at Morgan Stanley.

Expensive milk, eggs and completely different grocery objects are prime of ideas for lots of voters all through the nation as soon as they talk about worth pressures — and the best way they actually really feel regarding the broader financial system.

“The financial system sucks correct now,” talked about Avonti Fonville, a Ford worker in Wayne, Michigan, from the picket line sooner than his union, the United Auto Employees, struck a address the automaker remaining month.

“The value of meals has tripled since remaining yr and that merely makes it exhausting,” Fonville added, pointing to prices for eggs and meat particularly. “It’s exhausting to even dwell correct now. Going to the grocery retailer is a mortgage.”

A colleague moreover on strike shared the similar sentiment. “Ever since [Biden] took office, inflation has gone up,” talked about John Bugeja, together with that feeding his household was costing “not lower than one different $100, $150 bucks each week”.

That stress is being felt all through the nation. Wyatt Bradford, the general supervisor of a gift retailer and gallery in Jackson Hole, throughout the north-west state of Wyoming, says for his family of 4, frequent weekly grocery funds are topping $200, about $50 larger than it was three or 4 years previously.

“We’re undoubtedly going out fairly a bit decrease than we used to,” he gives.

In distinction with September 2022, meals costs are up nearly 4 per cent, with among the many largest will enhance seen in meat, bread and bakery objects. Egg prices have actually fallen nearly 15 per cent on an annual basis, in accordance with the latest CPI report, nonetheless People are nonetheless having to shell out further for a dozen than they did various years previously.

The similar is true for milk, although present assist has been far more subdued. Prices are down roughly 2 per cent on a year-over-year basis, nonetheless keep successfully in further of what People have been paying for the product earlier to the pandemic.

People going out to eat face even larger funds, with prices on the complete up 6 per cent in distinction with the similar time remaining yr.

The White Dwelling and Biden’s allies acknowledge that many People are nonetheless feeling the strains of extreme inflation, even when the tempo of worth will enhance has slowed on a month-to-month basis.

And analysts stage out that voters’ perceptions of the financial system is often a lagging indicator, and subsequently replicate the exact state of the financial system various months previously, comparatively than at present.

“Of us can’t really see what the financial system is doing for them correct now, nonetheless they’ll see what the financial system has accomplished for them the ultimate three months, or the ultimate six months,” says Shulman. “Insofar as points are getting larger, that basically implies that points have been worse.”

Francesco D’Acunto, an economist at Georgetown School who analysis the beliefs and financial decision-making of households, says individuals have a “very biased memory about what prices have been so far” and will sometimes overestimate the amount prices have elevated over time.

“They assume inflation is bigger than what it really is, because of they tend to recall lower prices for the ultimate yr than they’ve been actually paying,” he gives.

He believes that the majority individuals don’t understand that slowing inflation doesn’t suggest falling prices — and that deflation would nearly really correspond with a way more damaging monetary downturn.

If prices go down, D’Acunto gives, “that will have very harmful implications for [consumers] in a lot of respects. They is likely to be extra more likely to lose their jobs; they is likely to be extra more likely to have their wages cut back.”

The White House is hopeful that voters will rapidly see the benefits of the administration’s insurance coverage insurance policies. “Of us want their outdated prices once more — they want deflation, not disinflation,” says Jared Bernstein, who chairs the president’s Council of Monetary Advisers.

Nonetheless Bernstein gives that “shopping for power has gone up” because of the job market has remained strong whereas inflation has eased. “Individuals are able to buy the same amount groceries, as an illustration, for an hour of labor as they did sooner than the pandemic. That’s precise progress, but it surely absolutely’s one factor People should see for numerous months to essentially really feel larger about.”

Selling the benefits

Talking their monetary successes will most likely be key for Biden and the Democrats as they head into an election yr.

Quite a lot of them say that ought to start with acknowledging the worth pressures households are going by means of, whereas emphasising the tangible benefits of Biden’s legislative achievements, a whole lot of which have healthful assist.

A Navigator poll carried out by Democratic pollsters Worldwide Method Group and GBAO remaining month found that Biden’s flagship insurance coverage insurance policies — along with a switch to lower the worth of positive pharmaceuticals for seniors on Medicare, and the $1.2tn bipartisan infrastructure laws that invested billions in rebuilding bridges and roads and growing broadband entry — have been “strongly supported” or “significantly supported” by about three-quarters of registered voters, along with larger than half of Republicans.

That’s the message that Biden allies say should be hammered home. “The one issue you’ll be able to do is simply keep in mind to speak your legislative victories which will be serving to this financial system every day,” says Robert Wolf, a large Democratic donor and the earlier chair and chief govt of UBS Americas. “They need to do further of that . . . they need to discuss how this impacts each American wherever that problem is occurring.”

“It’s essential to proceed to discuss inflation coming down and wages doing larger, correct?” Wolf gives. “If shopping for power is more healthy, people ought to essentially really feel like they’re doing larger. Now we have now to get that out further.”

Nancy Pelosi, the earlier Democratic Speaker of the Dwelling, has acknowledged that the worth of residing was a “downside” for the president as he gears up for a re-election advertising and marketing marketing campaign.

Nonetheless speaking at an event in Washington remaining week, she was assured that clearly demonstrating what Biden has delivered — and what he would do with one different 4 years in office — might win over voters. “I really feel the messaging should be very clear about what he has accomplished, what it means and what we’ve left to do,” she added.

That can successfully present to be the case. The Navigator poll confirmed that Biden’s approval rating improved by double digits, along with by a sizeable 20 elements amongst independents, when voters have been instructed about his monetary insurance coverage insurance policies.

“Everyone knows that when individuals are educated, the appraisal of Biden goes up,” says Democratic strategist Simon Rosenberg. “That’s what campaigns are for. I really feel we are going to most likely be worthwhile at with the power to tell our story.”

There are completely different shifting parts that may work in Biden’s favour, considerably in an anticipated rematch with Trump. Whereas monetary sentiment might be a “essential topic” in subsequent yr’s election, argues Rosenberg, voter issues about Trump, who’s combating a group of licensed battles, have been extra more likely to outweigh any malaise in regards to the value of residing, pointing to remaining yr’s midterm elections when Democrats outperformed expectations no matter poor polling numbers and extreme inflation.

“There’s one thing that has been further extremely efficient than disappointment in Joe Biden in our politics, which has been fear of the extremism throughout the Republican celebration,” gives Rosenberg. “That has really been the driving stress throughout the remaining three elections and is extra more likely to be subsequent yr as successfully.”

Analysts stage out that with one yr to go many voters are often not however contemplating lots regarding the 2024 election, which suggests most people focus stays on Biden. “The prospect of a Trump presidency is far more distant than voters feeling the pinch correct now,” says Shulman from Beacon Protection Advisors.

“Nonetheless as a result of the election attracts nearer, and people go into their camps and the selection begins to rise . . . I really feel that may change how people view Bidenomics and their views of the financial system often.”

Additional reporting by Alex Rogers in Sunapee, New Hampshire, Claire Bushey in Wayne, Michigan, and James Politi in Washington

Data visualisation by Eva Xiao and Oliver Roeder

Thank you for being a valued member of the Nirantara family! We appreciate your continued support and trust in our apps.

-

Nirantara Social - Stay connected with friends and loved ones. Download now:

Nirantara Social

-

Nirantara News - Get the latest news and updates on the go. Install the Nirantara News app:

Nirantara News

-

Nirantara Fashion - Discover the latest fashion trends and styles. Get the Nirantara Fashion app:

Nirantara Fashion

-

Nirantara TechBuzz - Stay up-to-date with the latest technology trends and news. Install the Nirantara TechBuzz app:

Nirantara Fashion

-

InfiniteTravelDeals24 - Find incredible travel deals and discounts. Install the InfiniteTravelDeals24 app:

InfiniteTravelDeals24

If you haven't already, we encourage you to download and experience these fantastic apps. Stay connected, informed, stylish, and explore amazing travel offers with the Nirantara family!

Source link