This textual content is an on-site mannequin of Martin Sandbu’s Free Lunch publication. Be part of here to get the publication despatched straight to your inbox every Thursday

Greetings. This month, it’s 25 years since 12 EU nations merged their currencies and the euro was born. It took one different three years for euro banknotes and money to modify the francs and marks, pesetas and lire that preceded them, their change fees had been irrevocably fixed and the monetary system was working on euros all over the place nevertheless throughout the retailers. Below are some reflections on the best way it has turned out another way from what may have been anticipated. Nevertheless first, don’t neglect that the FT’s charity public sale continues to be working — and there are some bargain deals (lunch with me!) to be snapped up!

At an event this week, I and the other members have been set the subsequent “essay” question: “The euro isn’t what we anticipated it to be. Give attention to.” The options, the truth is, ought to depend on who you’re taking “we” to be.

I start by assessing the expectations of the critics of economic union. They predicted that merging the currencies of such completely completely different economies would make it so much harder to protect in the direction of uneven shocks. The harshest of them concluded that the euro would definitely disintegrate, besides it was complemented by an incredible leap of fiscal integration and transfers from creditor to debtor states — on which, see the next stage.

They centered, however, on the flawed shocks. Few had thought by the use of how stability of funds crises would work out, nor had many predicted that the euro would have the misfortune to be born into the biggest worldwide credit score rating bubble of all time, as I described in my book on the one international cash.

As for normal uneven shocks (modifications in relative objects prices, say, or idiosyncratic downturns), the euro made little distinction, and the soundness of funds crises have been, the truth is, managed (albeit badly) with out organising a fiscal union. So basically essentially the most stunning issue, from one place to start, is that the euro continues to be there, intact and, in precise reality, rising. I keep in mind a colleague, who shall keep nameless, forecasting after Greece’s near-exit from the eurozone in 2015, that not lower than one nation would depart the one international cash inside 10 years. Nevertheless not a single member has left, whatever the repeated Greek crises of 2010-15, and loads of new nations have joined, the ultimate being Croatia a yr prior to now.

The second stage is that every the detractors and loads of supporters anticipated monetary unification to energy the emergence of a fiscal and change union whose members put large budgets in frequent, the richer subsidising the poorer. Look to the US, the argument normally went, whose federal funds leads to reasonably extra redistribution between states than takes place between EU members. The monetary union will be “incomplete” with out such a system.

A leap of fiscal integration did occur in Europe in 2020. Nonetheless it was for the EU as a whole, not for the eurozone: the establishment of an €800bn post-pandemic resilience and restoration fund, which could go on to make grants (and loans) to member states backed by beforehand unthinkable frequent bonds. And the political and monetary motivations that made it happen related to not the one international cash, nevertheless to the one market. The fear was that nationwide funds help for companies and workers throughout the pandemic will be so uneven between nations that it’ll destroy the aggressive “diploma collaborating in space” and the one market itself. (This fear has returned throughout the case of nationwide subsidies for inexperienced and chips infrastructure and energy subsidies.)

That the logic of the one market proved stronger than the logic of the one international cash isn’t any small issue. The euro itself was partially motivated by the need to make the one market work increased: “One market, one money” the slogan went.

And phrase the parallels between proper now’s subsidy wars and the pre-euro aggressive devaluations in how they’re felt to undermine the extent collaborating in space throughout the single market. Inside the Eighties, the worry was that aggressive devaluations — stealing your neighbour’s demand to boost your monetary system — would undermine the strive at unifying the precise monetary system. Monetary unification eliminated nominal change value modifications contained in the bloc. Nevertheless the equivalent beggar-thy-neighbour impulse has proper now returned throughout the race to subsidise inexperienced enterprise, with monetary and political outcomes identical to the earlier aggressive devaluation draw back.

The menace posed by the subsidy race, however, is as soon as extra to the one market as a whole, to not the monetary union. Subsequently the dialogue on how the integrity of the one market requires each further self-discipline on subsidies or — further in all probability at a time when house cutting-edge inexperienced enterprise is a political essential — further frequent spending on subsidies on the EU diploma.

Remembering the one market helps us realise that a variety of the insurance coverage insurance policies and reforms with out which monetary union supposedly cannot function, are literally insurance coverage insurance policies and reforms required for an built-in monetary bloc — irrespective of international cash preparations — to hold out properly. Take banking union (unification of banking legal guidelines, a harmonised technique to determination and deposit insurance coverage protection, and eradicating of limitations to cross-border banking). The enterprise is now seen throughout the context of making the monetary union work properly, nevertheless the EU contemplated it in its own right prolonged sooner than the euro. It could properly have been put in place sooner — and the eurozone catastrophe might have carried out out another way if it had.

Or, take the case for transfers between richer and poorer states — that, too, may be important to equalise the optimistic points of economic integration and to maintain up public help for it, even between nations that don’t be a part of a typical international cash. As soon as extra, then, this generally is a motivation for fiscal integration that’s further strongly mobilised by the one market than the euro.

This isn’t to say that there aren’t some protection or institutional imperatives which may be distinctive to the euro. One is the need to acquire the right mixture fiscal stance of the eurozone nations put collectively, which turns into tough as quickly as monetary protection is unified nevertheless fiscal protection stays nationwide. The reform of the EU’s fiscal pointers (which I’m usually modestly optimistic about) missed a chance to position in place a powerful mechanism to guarantee that the eurozone nations collectively resolve the fiscal stance they suppose relevant. Nevertheless even when it isn’t ensured, it’s doable, and it’s to be hoped that the possibility to take motion will seemingly be seized throughout the eurozone’s budgetary politics going forward.

One different is the forthcoming digital euro — the retail central monetary establishment digital international cash that I’m assured the European Central Monetary establishment will start issuing inside a variety of years (in precise reality I’m on the file predicting it by the highest of 2025, which will be barely daring nevertheless perhaps not so much). Over at FT Alphaville, Bryce Elder has a nice piece on how the digital euro enterprise is, however, stymied by the ECB’s keenness to not disrupt legacy banks even one little bit. As he locations it: “If a European CBDC doesn’t break a variety of [banks], what’s the aim?” In any case, I imagine the digital euro will, in time, have the next impression than many seem to contemplate now — principally constructive even when, and even on account of, it’s disruptive — whether or not it’s allowed to take motion.

Most discussions of what the euro “needs”, however, are literally regarding the requires flowing from monetary integration usually, which is to say, the one market. Being lucid about that may make these discussions further constructive.

Totally different readables

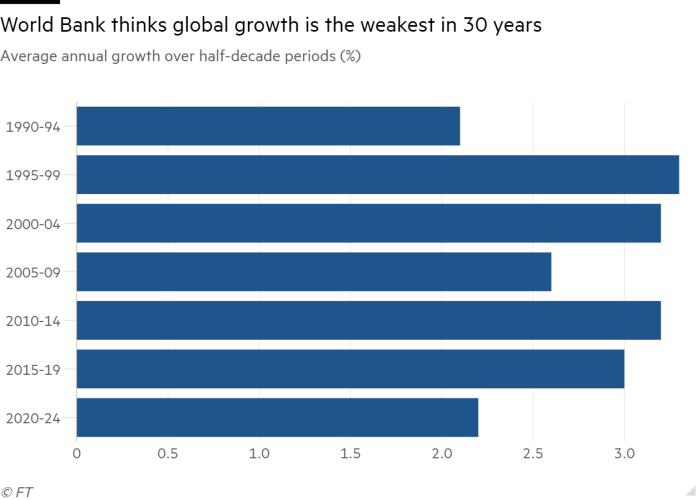

Numbers info

Actually helpful newsletters for you

Thank you for being a valued member of the Nirantara family! We appreciate your continued support and trust in our apps.

-

Nirantara Social - Stay connected with friends and loved ones. Download now:

Nirantara Social

-

Nirantara News - Get the latest news and updates on the go. Install the Nirantara News app:

Nirantara News

-

Nirantara Fashion - Discover the latest fashion trends and styles. Get the Nirantara Fashion app:

Nirantara Fashion

-

Nirantara TechBuzz - Stay up-to-date with the latest technology trends and news. Install the Nirantara TechBuzz app:

Nirantara Fashion

-

InfiniteTravelDeals24 - Find incredible travel deals and discounts. Install the InfiniteTravelDeals24 app:

InfiniteTravelDeals24

If you haven't already, we encourage you to download and experience these fantastic apps. Stay connected, informed, stylish, and explore amazing travel offers with the Nirantara family!

Source link